Buying bulk grain is different from buying a packaged product as the quality of the grain can impact both the price and even the quantity of the product you are buying. For example, as the elevator wants to pay for grain, not water, the gross weight of the grain will typically be reduced by the amount of moisture in the grain.

In addition, some facilities will deduct a standard percentage of the weight, (often referred to as ‘dockage’) as part of the cost of handling the grain. Alternatively, dockage maybe based on foreign materials in the grain sample, such as dirt or insects.

Discounts can also be positive, as you may wish to pay premiums for grain that is of a particularly high quality, or is delivered to the elevator at a particular point in time.

The costs (or unit deductions), are determined by the factor values. The unit deduction might be more for particularly wet grain, or the premium maybe higher for a higher protein percentage.

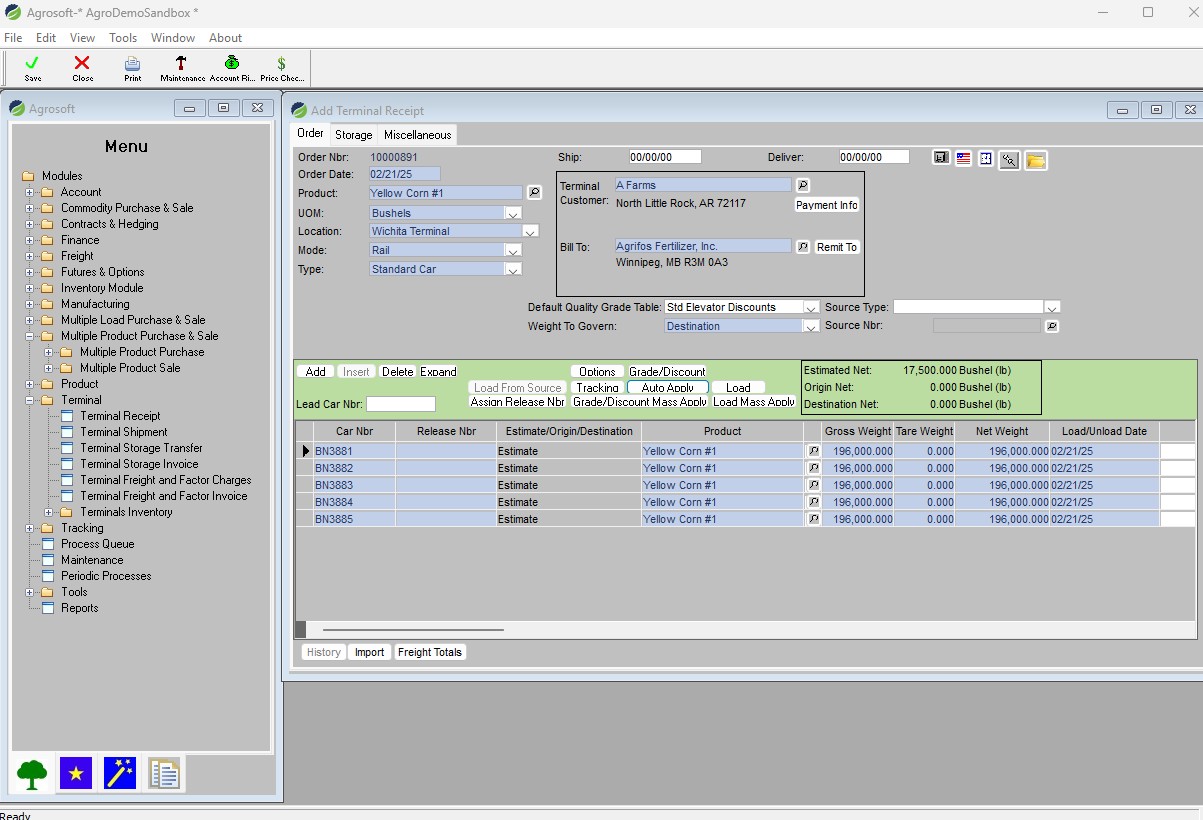

Grain accounting software such as Agrosoft and AgExceed can allow you to correctly record and discount your grain, is essential not only for pricing grain, but for tracking grain quality and proper elevator bin management. Grain merchandising contracts may use custom discount tables, which allow the elevators to discount grain according to a previously agreed upon rate schedule. CTRM (Commodity Trade Risk Management Software) that support these features are essential for blockchain food traceability and proper grain blending, as well as feed manufacturing and feed blending.

Probing Questions

When sampling, you may wish to take one or many samples. For example, with rail cars we support the ability to take a single composite sample that you apply to all cars, or take a sample for each rail car.

Discount Types

Agrosoft and AgExceed gives grain elevators the ability to create user defined grade/discount tables that allow them to record a number of different types of discounts, including

- Percentage of Unit Discounts – reductions in the quantity of grain paid for, typically used for factors such as water or foreign materials.

- Price Per Unit (Cents Per Unit) Discounts – A reduction per unit price, such as cents per bushel, typically taken for non-weight related quality factors such as broken kernels or heat damage.

- Percentage of Price Discounts – A reduction in the percentage of the per unit price, typically used for non weight related grading factors such as percentage of protein.

- Basis Price Adjustments – In addition, Agrosoft also allows you to adjust the basis price for factors such as delivery location or protein percentage, using an adjustment schedule predefined on the contract.

Calculated Weights and Tiering

We allow you to setup discounts for different calculated weight basis. The calculated weight basis is the weight that is used to compute the discount or premium. There are three calculated weight basis values:

Gross Unloaded Weight: The weight when the grain is unloaded. Typically this is the weight of the truck or rail car with the grain less the weight of the truck or rail car itself.

Gross Unloaded Weight After Dock / Shrink: The weight after the initial unit discounts are taken for dockage, moisture, or shrink. For example, you may take off the standard 1% dockage less the weight of any water before you even begin looking for other foreign materials.

Adjusted Net Weight: The weight of the grain after all unit discounts are taken.

Note that these are taken in sequence. If the grain is 15% water, you will reduce the weight of the grain from 1000 bushels to 850 bushels. At that point, you may take off discounts for other unit discount factors such as dirt, but the 1% discount would be on the remaining 850 bushels (8.5 bushels) rather than the original gross unloaded weight, which would have resulted in a 10-bushel deduction, thus recognizing the weight you have already reduced for moisture.

We also allow you to define user defined tiers, which enables you to take them in sequence, with up to 99 tiers. For example, assume you had a gross unloaded weight of 1,000 bushels:

Tier 1: 10% reduction of (1000 * .10) = 100 bushels

Tier 2: 10% reduction of (1000 – 100) * .10 = 90 bushels

Tier 3: 1% reduction of 810 * .01 = 8.1 bushels

Your total adjusted net weight in this example would be (1000 – 100 – 90 – 8.1 = 801.9 bushels.

This is a simple example, but as you can imagine the math can get quite complex. We document the math in the system, so not only can you see the answer, you can see how the computations are done. Math is always easier when you’re not the one doing it!

GSS Additional Discounting Features

- Ability to setup an unlimited number of table aliases. These allow you to print different names on contracts, if the person you are doing business with uses a different name for your discount table.

- Ability to setup an expiration date for a discount table. The table will not be available for use on new orders after the expiration date.

- Freezing grade/discount tables after they have been used on an order, so that monetary values will not be impacted by editing the original table. You can “alter” the table by using our import functionality to make a clone of the table, and then deactivating the old table for new loads in favor of the new, improved grade/discount table.

- Ability to specify which discount factors are required and which is optional.

- Also have the ability to setup multiple discounts for a single factor. For example, if you setup Moisture as a discount factor, you may wish to take a percentage of unit discount as well as a drying charge, based on the factor value. In Agrosoft, we enable you take two different types of discounts when entering a single factor.

- In AgExceed, the ability to specify delivery sheet minimums and maximums, so that grain that does not meet a certain minimum quality is not included in the discount calculations.

- Ability to specify which discounts print on the order and which do not print. This is useful for statistical factors which you wish to track, but which do not impact the price and should not be included on the settlement. For example, with Canola, you may wish to track PUFA (polyunsaturated fatty acids) which wouldn’t necessarily impact the price but which is important in the canola crush process.

- Ability to setup automatic grading, so that grades are automatically computed based on the discount factors.

- Ability to copy factors from other discount tables

- Support for Total Defects, where numerous factors can be added together and graded as if they were a single factor.

- Ability to vary discounts by apply type. For example, you might not charge drying if the grain is purchased, as opposed to being placed into storage.

- Ability to import one discount table to another.

In conclusion, there are many ways to discount grain, some which reduce quantity, and others that reduce price. Still others can offer premiums for quality. Regardless of your grade / discount method or strategy, Grossman Software Solutions has a solution for you.